Usefull Links

Tax Free Car Approval Malaysia my Second Home programme, MM2H

Application for the exemption of Tax / Duty on one motor car under Malaysia My Second Home programme (MM2H)

Tax Incentives

The MMSH participant may import one motorcar which belongs to him/her from his/her country of citizenship or where he/she last domiciled. He/she will be exempted from paying import duty, excise duty and sales tax on the imported motorcar.Or

The MMSH participant may purchase one new motorcar made or assembled in Malaysia. He/she will be exempted from paying excise duty and sales tax on the new motorcar.

Terms and conditions

The applicant is a participant of MMSH approved by Immigration Department of Malaysia.

An application to Import a motorcar from the participantfs country of citizenship/last domicile must be done within a period of six months from the date the MMSH visa is endorsed on his/her passport. The MMSH participant should be the owner of the motorcar as evidenced in the motorcar registration document prior to obtaining the MMSH visa.

An application to Purchase a new motorcar made or assembled in Malaysia must be done within a period of one year from the date the MMSH visa is endorsed on his/her passport. Do not make an outright purchase of the motorcar before obtaining approval for tax/duty exemption from the Treasury. However, a booking for a motorcar may be made prior to obtaining approval from the Treasury.

Importation or purchase of motorcar must be for personal use only and not for commercial use.

The MMSH participant is eligible for tax / duty exemptions for only ONE car.

Tax/duty exempted motorcars which are subsequently sold or transferred will be subjected to import duty, excise duty and sales tax according to the prevailing rates.

For the purpose of MMSH, a motorcar includes a saloon car, a multipurpose vehicle (MPV), a sports utility vehicle (SUV) and a 4-wheel drive vehicle. It excludes commercial vehicles such as vans, buses and lorries.

The application procedure

The following documents will be required for the application:

For an imported motorcar from the MMSH participantfs country of citizenship/last domicile:A certified copy of the letter from the Immigration Department of Malaysia that the applicant is a MMSH participant.

A certified copy of the international passport on :-

the page with personal particulars; and

the page with multiple entry visa as well as the words Malaysia My Second Home Programme.

A copy of the motorcar registration card. If not in English, please submit a translation.

For the purchase of new motorcar made or assembled in Malaysia;

A certified copy of the letter of approval from the Immigration Department of Malaysia that the applicant is a MMSH participant.

A certified copy of the international passport on:

the page with personal particulars; and

the page with multiple entry visa as well as the words Malaysia My Second Home Programme.

Quotation for the motorcar

Motorcar purchase order/order form [if possible].

Note: For the purchase of a motorcar, approval for tax exemption involves 2 stages:

Stage 1:

Approval on the brand and model of motorcar.

Stage 2:

Upon securing approval at Stage 1, the successful applicant has to furnish the Treasury with details of a specific motorcar allocated for him/her, namely the chassis number and the engine number. Subsequently, another approval letter will be given for Customs clearance for that particular motorcar.

Completed application form together with the required documents should be submitted to:-

Secretary-General, Treasury

Ministry Of Finance Malaysia

Tax Analysis Division

7th Floor, Central Block Presint 2,

62592 Putrajaya.

(Attention : Mr Yong Bun Fou)

Telephone : 603 - 88823380 Fax : 603 ? 88823885Further Enquiries: Ms. Norhayati Binti Ujang

Telephone: 603 ? 88823395

E-mail: yatie@treasury.gov.my

Duly completed application forms together with relevant documents are normaly processed within 10 working days.

You can import your own vehicle (subject to stated terms & conditions) and save a major amount of cash

We can complete the entire import / registration process on your behalf for a or a fee of RM3000 / £350, payable only after vehicle has been registered . E-mail us for futher information by clicking the link.

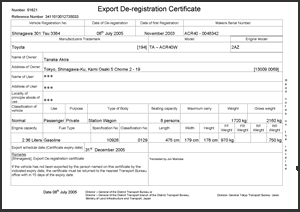

Importing a car from Japan, we can translate De-registration document to English for a small fee. Click here or on image for sample.

Click to Email: enquiries@penang-malaysia.com